𝐑𝐞𝐭𝐡𝐢𝐧𝐤𝐢𝐧𝐠 𝐭𝐡𝐞 𝟏𝟎% 𝐒𝐚𝐯𝐢𝐧𝐠𝐬 - 𝐑𝐮𝐥𝐞 𝐨𝐟 𝐃𝐮𝐦𝐛, 𝐈 𝐦𝐞𝐚𝐧𝐭 𝐓𝐡𝐮𝐦𝐛! 🤭

Many financial gurus or financial planners advocate this 10% savings rule, but let’s scrutinize the numbers and consider the implications for our financial future.

Some food for thought during your exciting working hours.

My question to you Today is: What % of your income 💰 are you putting aside (hope you are paying yourself first by now) into savings and/or investing? 10%? 30%? 50%? None? 🧐

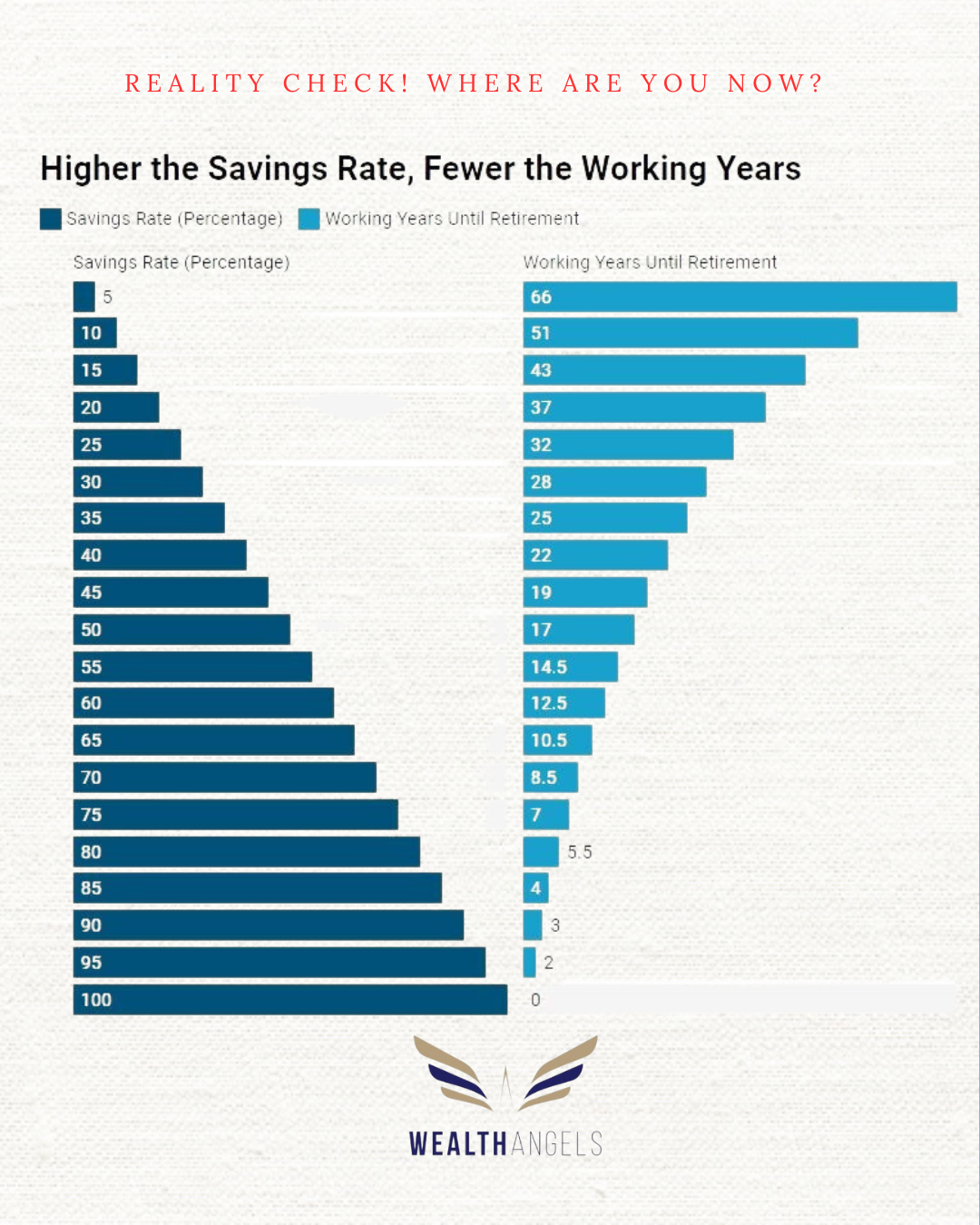

Look at the picture below and tell me what you think?!

💰 𝐑𝐞𝐚𝐬𝐨𝐧 #𝟏:

With the 10% rule, you need 51 Years to retire! Yes, seriously! And these number assumes your money is working at a 6% Return on your Investments after inflation. If you let your money enjoy the bank’s air conditioning, then, you would be the one that will need to sweat till… ‘forever’🕰️

📈 𝐑𝐞𝐚𝐬𝐨𝐧 #𝟐:

The ROI Reality Check Sure, your money is chillin’ in a bank, but is that really making it grow? With high inflation rates, we need to make an additional effort to make our money work harder for us, and not us for it, to gain at least 6% returns after tax and inflation adjustment. 💸

⏳ 𝐑𝐞𝐚𝐬𝐨𝐧 #𝟑:

Thanks to technology, life’s span will be extended further. But can your savings keep grooving for an extra 30 or 40 years after retirement? Let’s ensure our financial dance floor stays lit long into the night. 🎉

🔮 𝐅𝐢𝐧𝐚𝐥𝐞:

The Success Formula Unveiled

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐟𝐫𝐞𝐞𝐝𝐨𝐦 = 𝐒𝐚𝐯𝐢𝐧𝐠𝐬 𝐑𝐚𝐭𝐞𝐬 𝐱 𝐑𝐞𝐭𝐮𝐫𝐧 𝐨𝐧 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭.

The higher you rev those engines, the faster you’ll rocket to your dreams. 🚀

💡 𝐂𝐓𝐀: What can you do today to increase your saving rates and also your Return on Investments?

It is important to remember that it is not the amount you make as income but the GAP between the Income and expenses. We called it SAVING RATES. The higher it is, the faster you will get to your goals.

It’s time to define your financial destiny, one bold decision at a time!!!

With Love and Compassion,

Diego